Peak oil what?

September 20, 2006 12:07 PM Subscribe

Why have the gas prices fallen rapidly in the last few weeks?

So, all the apocalypse, left-wing(?) type blogs earlier this year claimed that we're at the peak of 'Peak oil' and sht is about to hit the fan. The gas prices rose sky-high here in Canada. I started going across the border to the US to fuel up to save $10/tank. Well, couple of weeks ago I noticed that gas prices have fallen to late 2004/early 2005 prices (to low $0.90s/liter, down from high $1.20 earlier in the summer).

What is the reason for this and how does it relate to the "peak oil" claims?

Couple of guesses:

1. There's usually a seasonal drop in prices (but certainly not 25% like this time).

2. Refineries off the Gulf of Mexico are back in action.

3. Big Oil Cos have never had a shortage of gas, they artificially inflated prices through some sort of financial machinations.

Where does this leave us? If we are at the peak, the prices should continue rising steadily (unless this rapid hike over the last year was speculation by Big Oil, OPEC and so on). If we are not at the peak, why are we allowing this price gouging to go on? Bottom line, what is the per barrel cost of gas going forward in a year, 5, 10?

So, all the apocalypse, left-wing(?) type blogs earlier this year claimed that we're at the peak of 'Peak oil' and sht is about to hit the fan. The gas prices rose sky-high here in Canada. I started going across the border to the US to fuel up to save $10/tank. Well, couple of weeks ago I noticed that gas prices have fallen to late 2004/early 2005 prices (to low $0.90s/liter, down from high $1.20 earlier in the summer).

What is the reason for this and how does it relate to the "peak oil" claims?

Couple of guesses:

1. There's usually a seasonal drop in prices (but certainly not 25% like this time).

2. Refineries off the Gulf of Mexico are back in action.

3. Big Oil Cos have never had a shortage of gas, they artificially inflated prices through some sort of financial machinations.

Where does this leave us? If we are at the peak, the prices should continue rising steadily (unless this rapid hike over the last year was speculation by Big Oil, OPEC and so on). If we are not at the peak, why are we allowing this price gouging to go on? Bottom line, what is the per barrel cost of gas going forward in a year, 5, 10?

The reason for the decline isn't clear.

Several reasons account for declining gas prices.

posted by ericb at 12:16 PM on September 20, 2006

Several reasons account for declining gas prices.

posted by ericb at 12:16 PM on September 20, 2006

I bet that Saudi Arabia is manipulating OPEC to keep prices down in the run up to the 2006 midterm elections.

posted by dudeman at 12:24 PM on September 20, 2006

posted by dudeman at 12:24 PM on September 20, 2006

And I don't want to hijack, but I think this is a relevant/related question: is there anywhere that lists a breakdown of the price of gas at the pumps? Eg. what percentage goes to the station, percentage for taxes (which varies by location, obviously), percentage for transport, percentage to the oil company, etc. This could shed some light on the changes as well.

posted by inigo2 at 12:53 PM on September 20, 2006

posted by inigo2 at 12:53 PM on September 20, 2006

inigo2, even that doesn't cut it. Stations in Toronto have sold gas under cost in the last few months. Not for long, but it happens. The cost of inputs is only a small part of how gas prices are determined. Part of it has to do with the station's own tank size and their expected outflow before the next refill (i.e. if the station is low on gas, they may raise prices to keep from running out). Part is competitive pricing. Gas pricing is right up there with airline ticket pricing for complexity and opacity.

posted by GuyZero at 12:59 PM on September 20, 2006

posted by GuyZero at 12:59 PM on September 20, 2006

I bet that Saudi Arabia is manipulating OPEC to keep prices down in the run up to the 2006 midterm elections.

Yeah totally dudeman, same way they did in 2004! Oops, prices were higher than ever in November, 2004.

posted by evariste at 1:05 PM on September 20, 2006

Yeah totally dudeman, same way they did in 2004! Oops, prices were higher than ever in November, 2004.

posted by evariste at 1:05 PM on September 20, 2006

Just found this website that has historical gas prices, and a gas price primer. Doesn't explain everything, but has some info. Lots of interesting stuff on there.

posted by inigo2 at 1:09 PM on September 20, 2006

posted by inigo2 at 1:09 PM on September 20, 2006

OPEC agreed to not artificially reduce supply for the immediate future recently, didn't they?

posted by Mr. Gunn at 1:12 PM on September 20, 2006

posted by Mr. Gunn at 1:12 PM on September 20, 2006

i agree with bit. the huge discovery in the gulf has everyone thinking twice about that apocalypse.

posted by sophist at 1:14 PM on September 20, 2006

posted by sophist at 1:14 PM on September 20, 2006

I read in my local paper this morning that US$1.15/gal is coming back.

posted by Doohickie at 1:18 PM on September 20, 2006

posted by Doohickie at 1:18 PM on September 20, 2006

The 'scientific' answer is what everyone has said, the cynical answer is that its coming up on elections.

posted by legotech at 1:19 PM on September 20, 2006

posted by legotech at 1:19 PM on September 20, 2006

the cynical answer is that its coming up on elections. - legotech

Doesn't really explain Canada, since we (probably) don't have upcoming elections.

posted by raedyn at 1:29 PM on September 20, 2006

Doesn't really explain Canada, since we (probably) don't have upcoming elections.

posted by raedyn at 1:29 PM on September 20, 2006

Oil and other commodities have been the subject of a lot of speculative investment of late. An article in The Economist earlier this summer reported estimates that the price of crude was inflated by speculative pressures by as much as 50%.

It's got to be a combination of reasons.

As for the whole idea of Peak Oil. I think it's a flawed theory. Cheap oil is a fungible commodity. If it gets too expensive, there are substitutes.

With prices high, there are lots of potential substitutes. The biggest substitute for cheap oil right now is expensive oil. As prices go up, previously useless reserves become economical to exploit. Examples include canadian tar sands, and that deep water discovery in the Gulf of Mexico.

And, of course, there is ethanol & butanol from renewable sources, etc, etc.

posted by Good Brain at 1:30 PM on September 20, 2006

It's got to be a combination of reasons.

As for the whole idea of Peak Oil. I think it's a flawed theory. Cheap oil is a fungible commodity. If it gets too expensive, there are substitutes.

With prices high, there are lots of potential substitutes. The biggest substitute for cheap oil right now is expensive oil. As prices go up, previously useless reserves become economical to exploit. Examples include canadian tar sands, and that deep water discovery in the Gulf of Mexico.

And, of course, there is ethanol & butanol from renewable sources, etc, etc.

posted by Good Brain at 1:30 PM on September 20, 2006

IMO the main reason for the decline is just that prices got too far ahead of the curve. All that talk about peak oil, fear of hurricanes and Iran, China, hedge funds, etc., led to speculation that drove prices up too far. Now, all the talk about some big new oil discovery, the lack of hurricane-related problems this year, economic growth slowing down, etc., are probably driving prices down too far in reaction. Keep in mind, though, that not too many months ago, 85 cents a litre would not be considered inexpensive. The long-term trend to higher prices is damaged, but not necessarily reversed just yet.

posted by sfenders at 1:36 PM on September 20, 2006

posted by sfenders at 1:36 PM on September 20, 2006

someone needs to plot crude prices and gas prices vs. election seasons.

while i dont doubt that market forces / psychology are influencing the price of crude, it seems that gas prices have fallen 20-30% here in california. i dont think that oil is down 30% per bbl vs. 1.5 months ago, right?

i think its naive to think that a small group of companies/countries do not try to influence politics by controlling the price of energy. its not hard for the saudis to increase supply for a short amount of time, nor is it hard for the oil companies to forgo a little bit of profit in the short term to make sure their 'guys' are in control in washington.

posted by joeblough at 2:19 PM on September 20, 2006

while i dont doubt that market forces / psychology are influencing the price of crude, it seems that gas prices have fallen 20-30% here in california. i dont think that oil is down 30% per bbl vs. 1.5 months ago, right?

i think its naive to think that a small group of companies/countries do not try to influence politics by controlling the price of energy. its not hard for the saudis to increase supply for a short amount of time, nor is it hard for the oil companies to forgo a little bit of profit in the short term to make sure their 'guys' are in control in washington.

posted by joeblough at 2:19 PM on September 20, 2006

If we are at the peak, the prices should continue rising steadily--

Not true. In the short term, the price of oil will rise whenever the risk of a political crisis in a major oil-producing country increases (Iran, Nigeria, Indonesia, Venezuela), and fall whenever the risk decreases.

posted by russilwvong at 2:29 PM on September 20, 2006

Not true. In the short term, the price of oil will rise whenever the risk of a political crisis in a major oil-producing country increases (Iran, Nigeria, Indonesia, Venezuela), and fall whenever the risk decreases.

posted by russilwvong at 2:29 PM on September 20, 2006

The elections in November, obviously. Check back in December.

posted by trii at 4:29 PM on September 20, 2006

posted by trii at 4:29 PM on September 20, 2006

ah well i heard on the radio that the price of crude is down $20/bbl since the middle of the summer. and that's like 25%.

still, how conveeeeeeenient, as the church lady would say.

posted by joeblough at 9:06 PM on September 20, 2006

still, how conveeeeeeenient, as the church lady would say.

posted by joeblough at 9:06 PM on September 20, 2006

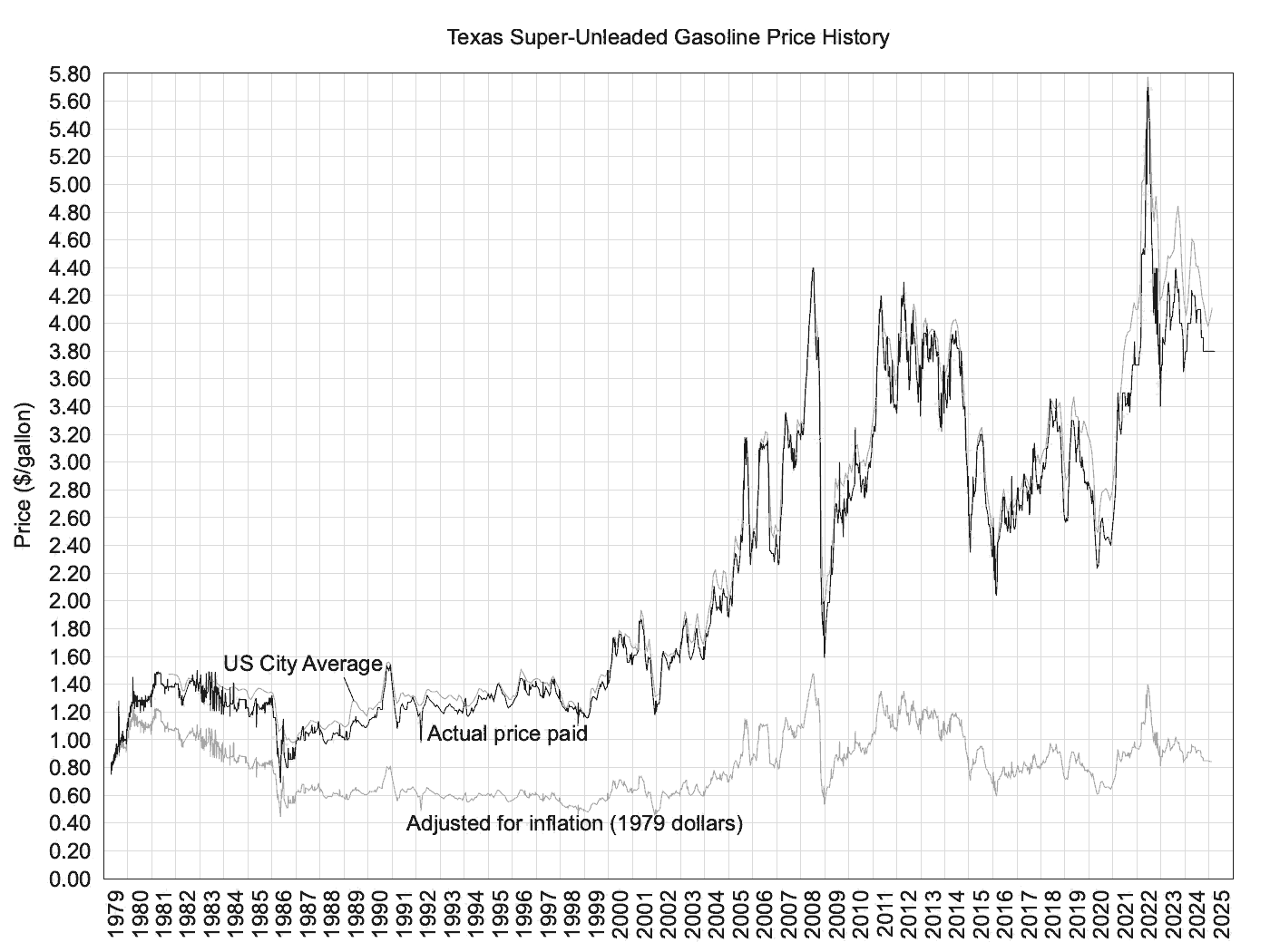

this is what one guy says he's paid for gas in texas since 1979 ... (the light gray line next to this is nationwide, though)

there does not seem to be a correlation between gas prices and elections

the price in today's dollars is STILL pretty high

however the price in constant dollars isn't more than it was in 1980

posted by pyramid termite at 9:34 PM on September 20, 2006

pyramid termite: there does not seem to be a correlation between gas prices and elections

Really? What method did you use to look for one? I took the numbers from that chart and added them up:

Average yearly price increase: 5.8 cents

Average in years divisible by four: 3.5 cents

Years not divisible by four: 6.6 cents

Even-numbered years: 3.9 cents

Odd-numbered years: 7.8 cents

Admittedly that is not much like a real statistical analysis, but it does suggest that there might be something there.

the price in today's dollars is STILL pretty high ... and the price in inflation-adjusted dollars is also pretty high. It's not like 1980 was normal.

posted by sfenders at 6:10 AM on September 21, 2006

Really? What method did you use to look for one? I took the numbers from that chart and added them up:

Average yearly price increase: 5.8 cents

Average in years divisible by four: 3.5 cents

Years not divisible by four: 6.6 cents

Even-numbered years: 3.9 cents

Odd-numbered years: 7.8 cents

Admittedly that is not much like a real statistical analysis, but it does suggest that there might be something there.

the price in today's dollars is STILL pretty high ... and the price in inflation-adjusted dollars is also pretty high. It's not like 1980 was normal.

posted by sfenders at 6:10 AM on September 21, 2006

... a closer look at the data shows that it really requires more analysis than I gave it above. I won't bore you with the details. But if you consider that data enough to decide whether there are some correlations between elections and gas prices, which I don't, then there are some big ones.

posted by sfenders at 8:06 AM on September 21, 2006

posted by sfenders at 8:06 AM on September 21, 2006

Bill Cara has two excellent posts today relevant to this question. Presidential popularity looks to be closely related to US gasoline prices lately. And the MTBE thing has obviously had some effect.

posted by sfenders at 9:53 AM on September 21, 2006

posted by sfenders at 9:53 AM on September 21, 2006

Cheap oil is a fungible commodity. If it gets too expensive, there are substitutes.

Sort of. There are substitutes, but they are mostly immature, which huge strides having been made with high oil prices. I would not put it past OPEC to sell oil at a loss for a few years to cause alternative fuel developers to go belly-up.

posted by blueshammer at 9:57 AM on September 21, 2006

Sort of. There are substitutes, but they are mostly immature, which huge strides having been made with high oil prices. I would not put it past OPEC to sell oil at a loss for a few years to cause alternative fuel developers to go belly-up.

posted by blueshammer at 9:57 AM on September 21, 2006

I would not put it past OPEC to sell oil at a loss for a few years to cause alternative fuel developers to go belly-up.

A government-guaranteed floor to prices at the pump (enforced by sliding-scale taxation up to that level) would eliminate OPEC's power to kill competitors with price-dumping.

posted by evariste at 11:05 AM on September 21, 2006

A government-guaranteed floor to prices at the pump (enforced by sliding-scale taxation up to that level) would eliminate OPEC's power to kill competitors with price-dumping.

posted by evariste at 11:05 AM on September 21, 2006

Blueshammer, OPEC has been trying to keep oil prices low enough to discourage substitutes since the late 70s when they saw how consuming nations reacted to high oil prices. OPEC manipulates prices by controlling supply, but these days, demand is high enough that their ability to swing prices is limited.

BTW, you've quoted me out of context. My main point is that we've seen very clearly that people will buy expensive oil if cheap oil isn't available. And when oil is going for $50+ a barrel, it becomes profitable to extract oil from all sorts of reserves that would be unprofitable at the historical average of ~$25/barrel (in todays dollars).

posted by Good Brain at 11:12 AM on September 21, 2006

BTW, you've quoted me out of context. My main point is that we've seen very clearly that people will buy expensive oil if cheap oil isn't available. And when oil is going for $50+ a barrel, it becomes profitable to extract oil from all sorts of reserves that would be unprofitable at the historical average of ~$25/barrel (in todays dollars).

posted by Good Brain at 11:12 AM on September 21, 2006

This thread is closed to new comments.

posted by mbrubeck at 12:15 PM on September 20, 2006